Avoid confusions: New Legislation – Sick Leave 10 days per year

From July 24, 2021 employee’s sick leave has gone up from 5 days to 10 days per year, and this will happen for any employee who reaches either their 6-month anniversary or yearly anniversary with an employer.

This doesn’t mean that employees will start getting five more sick days per year starting from July 24, 2021. For example, if an employee’s anniversary date is on July 23, you get new 5 sick days for the coming year, so an employee won’t get an increase until July 23, 2022. In addition, if you are a new employee, you will be entitled to 10 sick days as soon as you become entitled to sick leave.

Employees can spend sick leave when they are unwell or injured and need to care for family members who are ill or depend on them for care.

If an employee was already allotted ten or more sick days a year, they would not be affected directly by this change in the minimum number of sick days.

Sick leave entitlement is not pro-rated, which means that you would still get ten sick days per year even if you work part-time three days a week. Therefore, everyone can accumulate up to 20 sick days a year.

Employees wouldn’t be eligible for payment of sick leave if the day they were sick wasn’t a day they would have otherwise worked.

Sick leave is defined as days rather than hours. This means that if an employee works for part of the day and then goes home sick, this may be counted as using a whole sick day, no matter how much of the day they have worked. However, in some cases If an employee works a half-day then goes home sick, their employer could agree to only deduct a half-day of sick leave (which would be better for the employee). Payment for this half sick leave day would be half of their daily pay or average daily pay.

Ransomware: one click can make you spend a fortune. Is your business at risk?

Ransomware is a type of malware that encrypts your files and makes them unusable in order to extort money from you and your company. There are various ways to distribute ransomware, the most common being via email attachments or malicious links downloaded from phishing sites.

Ransomware can infect any computer or device you use, not just work machines. It doesn’t matter if you work in a bank or insurance company. Everyone is vulnerable to this type of malware.

Attackers target businesses and demand the ransom to be paid quickly, and many companies bear the burden of ransomware. But these criminal activities are now threatening organizations in every industry.

Despite its reputation as a cybercrime tool, ransomware has become mainstream in the past few years and is no longer exclusive to malicious hackers looking to make a profit. With the increase of targeted attacks aimed at large corporations, it’s easy to see how it earned a spot among modern threats.

If you’re attacked, don’t pay the ransom—it only encourages more cybercrime.

If you pay a ransom, there is NO guarantee that your files will be returned to you. In addition, if you pay the ransom, the attacker can gain access to your computer again and again.

Here is what you should be doing if you are targeted:

If you’re targeted, the more quickly you get your network offline, the more you can contain the spread of the malicious software. The less time your system is connected to the internet, the less time it’s vulnerable.

Seek the advice of an IT professional. When you’re faced with cyber-crime, your first instinct may be to turn to your IT department. After all, when it comes to information technology, no one knows the scoop like an insider. And if your IT guru isn’t available, don’t panic. There are plenty of companies that offer tech support for a variety of issues, including ransomware attacks. After a breach, try to understand how the attackers got in.

If you’ve already paid a ransomware fee to get your files back, your computers might still be compromised, and you should take steps to ensure that no other parties can access your data.

If you or your business experiences ransomware or another cyber security issue, use this form to report it to CERT NZ.

Here is how you can protect your business:

-

- Be cautious about clicking on links in emails that you’ve received from unknown senders. Make sure your computer’s software is always up to date and that your employees know how to spot dodgy emails. You should always look at the URL when you’re signing into a site and check it against the page you expect, the sender of unexpected emails to see if they match and be wary of any emails that contain attachments.

- Make sure you install every available update to your devices and software as soon as it comes out. This will ensure that your systems are protected against emerging threats.

- Add two-factor authentication to your accounts. This is typically a code that’s sent to your phone or an authentication app to verify your identity. This adds an extra layer of security to your logins.

- Always keep a copy of your business data elsewhere. If your storage is compromised or if it breaks down, you’ll have an easy way to get back up and running.

- There are many different types of logs that can be used to monitor your website and systems. Contact your IT team or service provider to determine what’s right for you. Logs will let you know if any unusual or unexpected activity occurs.

- You should always have an incident response plan in place because no matter how well you prepare and how good your cybersecurity is, things can still happen. You don’t want to be left without a backup plan. Make copies of all important documentation and know who to call in case you can’t access your system.

How will extended sick leave, Covid-10 vaccination and other new changes will affect your business and employees?

Here is what you need to know about extended sick leave, Covid-19 vaccination, updating employment agreements and taking bereavement leave to cover miscarriage and stillbirth.

Sick Leave

From 24 July 2021, the number of sick leave days will increase to 10 days per year. This means that employees will be getting extra five days of sick leave (including caring for a sick or injured dependant) either when they reach their next entitlement anniversary or after reaching six months’ employment. The maximum amount of unused sick leave that an employee can be entitled to will remain 20 days.

Up-to-date Employment Agreements

All employees must have a written employment agreement with the latest updated information, e.g. position, duties and responsibilities, hours of work, salary/hourly rate, type of employment, trial period. Employment NZ has an excellent tool that helps to build an employment agreement within a few minutes, and you can add any additional clauses.

Bereavement Leave to cover miscarriage and stillbirth

The latest law changes will allow employees to take up to three days of paid bereavement leave if they or their partner experience a miscarriage or stillbirth. In the event of surrogacy or adoption, if the pregnancy ends up by miscarriage or stillbirth, the eligibility of taking up to three days bereavement leave still applies.

The bereavement leave does not have to be taken straight away and can be taken at any time and for any matter related to the bereavement. The stand-down period of 6 months applies to new employees. There is no requirement to produce proof of pregnancy, miscarriage or stillbirth.

Covid-19 vaccination in the workplace

There are ways your business can support the Covid-19 vaccination campaign, and the most effective are: removing costs, travel or time off work removed. You could also: allow your employer to get vaccinated during work hours without needing to take time off work or using annual leave; provide up-to-date and relevant information about vaccination from the MOH or DHB; if asked by MOH or DHB, organise vaccination at your workplace.

If they refuse to be vaccinated, firing or dismissing employees should be the last option, as advised by Employment NZ. Every business will need to decide if there are any positions and duties that vaccinated employees can only perform depending on whether your work is covered by Health Order or for health and safety reasons. If you think there may be roles like this in your business, you will first need to evaluate them for Covid-19 exposure and transmission risks. Suppose you identify the positions where the risks are high, or your employees fall under a Health Order. In that case, there are several things you must take into consideration before dismissing an employee:

– Conducting employees and the union (if applicable) for lawful solution

– Making changes in work arrangements or duties performed by the employee permanently or for some time

– Offering and agreeing with an employee to some type of leave

– Restructuring business or the work

– Medical incapacity where employers should follow any contractual process including notice period and compensation

Before considering changes to roles or work, it’s essential to consult with employees and agree that changes to their work are possible and desirable. This may include location, hours of work, change of duties, transfer to other positions that no longer have a high risk of exposure. There may be cases where vaccination needs to be postponed due to some medical reasons, which means that specific tasks performed by the employee will need to be postponed too.

You cannot make your employee get vaccinated. Employers can only require that specific roles are performed by employees vaccinated if a Health Order covers the work or if a risk assessment shows a high risk of getting and infecting others with COVID-19.

If a Health Order does not cover your business, and you think vaccination of your employees might be needed, you must evaluate Covid-19 exposure risk. To do that, you must carry out a risk assessment for exposure to Covid-19, which includes two main factors: how likely the employee is to be exposed to Covid-19 while performing the role and the potential community spread. Suppose there is a high likelihood that the employees may be exposed to Covid, which would be significant for other people. In that case, the role likely needs to be performed by a vaccinated person.

You cannot make your employee get vaccinated for any other reasons, as it would be considered as a form of medical treatment solely for a marketing benefit.

In a situation where it has been identified that the role needs to be performed by the vaccinated person, but the employee does not intend to be vaccinated, employers should work through the process with the employee in good faith before making the final decision.

If vaccination is required, you may ask employees to take annual leave, but you cannot force them without their consent. You can direct employees to take annual leave but only if they have annual leave available and a notice of at least 14 days is given by the employer.

Please note that if an employer has directed their employee to take unpaid leave, this could be seen as the employer unlawfully suspending the employee.

A person’s vaccination status is personal information, which means it can be collected, stored, and shared according to the Privacy Act. Businesses can only ask candidates if they are vaccinated when the requirements of the role justify it.

Interest deductions on residential property income & Bright-line test 2021: What the proposed changes mean to you

There have been proposed changes for residential properties acquired on or after 27 March. The current law states that residential property owners can deduct the interest on loans when calculating their taxable incomes and claim them as an expense. This reduces the tax amount they need to pay.

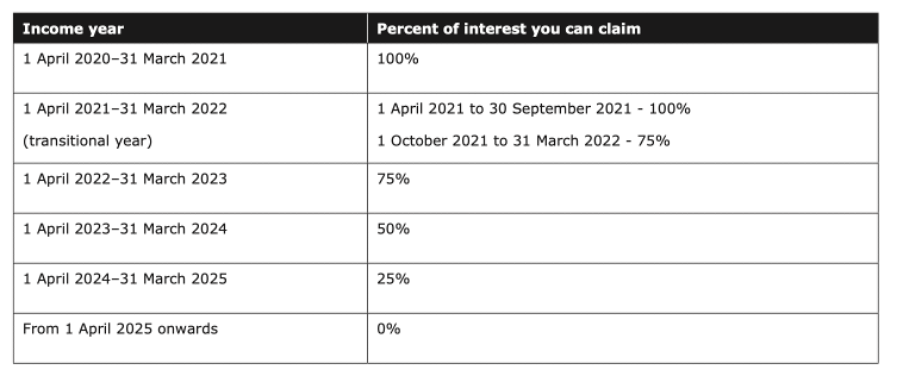

From 1 October 2021, there will be no interest deductions allowed on residential properties acquired on or after 27 March 2021. Interest on loans can still be claimed as an expense; however, the amount you can claim will be reduced over the next four years until it is completely eliminated. The table below shows that the interest amount claimed as an expense will be reduced by 25% each income year and eliminated by 2025-26 income year.

You can request further information or give us a call, and we will guide you through the latest changes and what they mean to you and your income tax.

What happens if you got a loan to improve or maintain your property on or after 27 March 2021? You will not be able to claim interest on this loan as an expense starting from 1 October 2021. This means that you will pay more tax on any property income you receive.

Say you made an offer before 27 March 2021 but acquired property on 27 March. Then your property will be treated as it was acquired before 27 March. This means that you will be able to claim interest as an expense based on the table provided above.

Obtaining any additional debt from drawing on the loan or taking a new loan related to the investment property on or after 27 March 20201 means interest on that portion of the loan will not be claimed as an expense after 1 October 2021.

When obtaining a loan for business use but secured against residential property, no changes are applied. Builders and property developers will be able to claim interest on a loan as an expense.

Bright-line test proposed changes

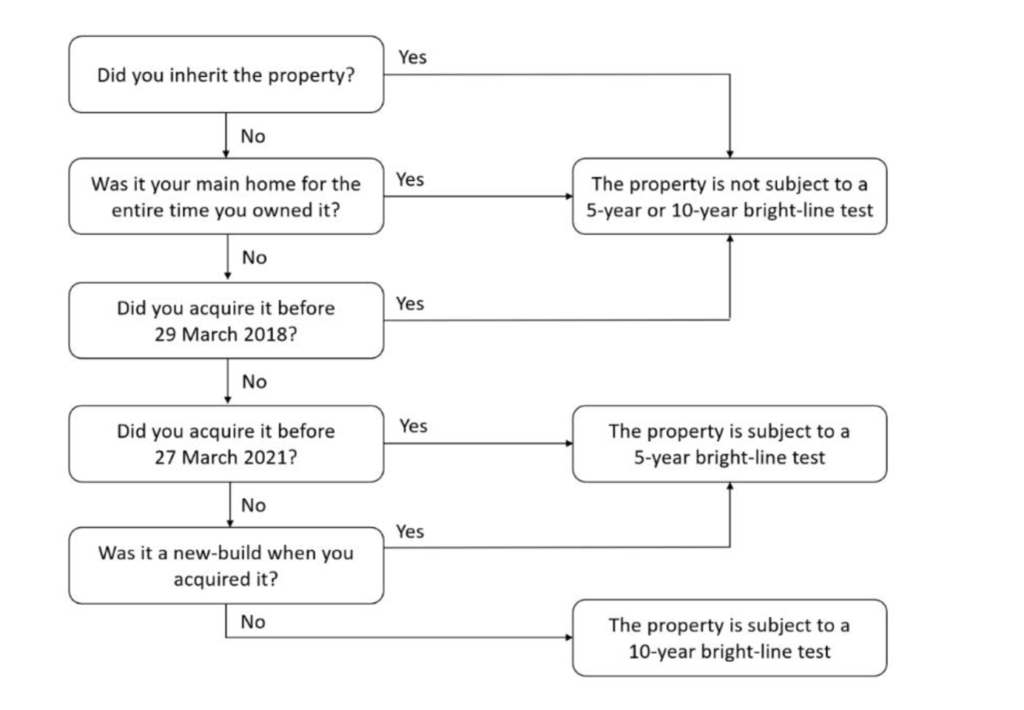

The government proposed the bright-line test to be extended from 5 to 10 years, which means that you will have to pay tax on any profit made through property increasing value over time for a set period after acquiring a residential property. Newly built houses are an exception and inherited properties and those considered as owner’s primary home for the entire time they owned it.

The chart below provided by IRD explain the proposed changes to the bright-line test.

The date you acquired a property determines whether the bright-line is 5 or 10 years. This will also determine which set of rules relating to the main home exclusion and change of use will apply to your property.

There is no clear definition of a new build as yet, and it will be defined and clarified in consultation with the tax and property communities. The intention is to define a new build as property acquired within a year of receiving a code of compliance certificate under Building Act 2004.

If a residential property, including new builds, is acquired on or after 27 March 2021, there may be a “change-of-use” rule applied by the government. This basically means that tax will be calculated differently if the property was not used as the owner’s main home for over 12 months at a time during the applicable bright-line period.

If the owner does not use the property as the main home for 12 months or less there is no change of use (for example) if the owner takes a few months to move into our out of a property this till means that the days are counted as main home use and the bright-line test is not applied.

The owner of a property subject to the change-of-use rule will be required to pay income tax on a proportion of the profit made through the property increasing in value, calculated as follows:

• subtract the purchase price from the sale price

• subtract the cost of capital improvements the owner has made

• subtract the costs to buy and sell the property, and

• multiply the result by the proportion of time the property was not being used as the owner’s main home.

What the proposed changes mean for you

If you own property for more than ten years (or over five years for new builds), you won’t have to pay tax under the bright-line test.

If a property is sold within ten years of acquiring it (or five years for a new build) and it was the owner’s main home for the entire time, there is no obligation to pay tax under the bright-line test on any value gain of the whole period. In case of the property being used for other purposes for over 12 months during the time owned, there is an obligation to pay income tax on the value gained over time, and it is considered as profit.

If the owner decided to sell the property within ten years of acquiring it (or five years for a new build) and it was never owner’s main home for the entire time of ownership, there will be income tax to pay on any value gained under the bright-line test.

Contact Spectrum Accounting for an initial consultation, and as tax consultants, we will help you have all your taxes under control.

The benefits of Cloud Accounting for small businesses

When we talk about “Cloud Accounting”, we essentially mean accessing your accounting software application from anywhere in the world. Cloud accounting has taken the pressure off the business owners who struggled with physical computer storage access, hard drive crashing or outdated software that needs reinstallation and license keys. Lots of our clients switched to Xero and described it as the best tool for managing their accounts. Whether you are in a coffee shop, skiing in Queenstown or relaxing on the beach in the Bay of Plenty, you can access your data.

You might be thinking that it might not be the most secure option; however, the latest accounting software applications have increased security and have a constant back up, which mean you can relax and focus on what matters in your business.

Another reason to switch to Cloud accounting is the time that you will save. No more adding data into spreadsheets manually – you will have a state-of-the-art software application at your fingertips that will allow you to save time doing the books. Free trials of some of the most popular cloud-based accounting solutions are available. At Spectrum Accounting, we are Certified Xero champions. You can ask us today, and we will be happy to provide some advice and guidance.

You can also grant access to your account to your employees, share information and integrate it with popular file storage solutions, such as Dropbox.

Reporting and meaningful insights are available at all times when you manage your accounts online. Set up tax reminders and check when you tax payment are due. Check how much cash you have in business and what your projected income looks like for the months ahead. Identifying who still owes you money is easy – you can see any outstanding invoices and keep track of bad debts until they are cleared. We at Spectrum Accounting choose to use IPayroll as we think this is the best payroll system, which we can set up for your business and assist with the day to day tasks.

Let us introduce you to cloud-based accounting and offer you on-going support. Talk to us today, and we will show you how to make a positive change in your business.