Balance Sheets Explained

If you have been in business for a while, you will have almost certainly heard the term Balance Sheet. If you are new to business however, you may find yourself preparing a Balance Sheet for the first time. Here is a basic overview of a Balance Sheet and when you might need one.

What is a Balance Sheet?

A Balance Sheet is a financial summary and should give an overview of the financial health of your business. Like the name suggests, it essentially balances the what the business owns versus what it owes, leaving the overall value of the business or owner’s equity.

What is a Balance Sheet used for?

For business owners the Balance Sheet gives a snapshot of the financial position of the business. It can help guide their business strategy going forward. In New Zealand, the IRD require a Balance Sheet dated at the end of the financial year as part of completing an IR10 or Financial Statements Summary. Balance Sheets are also used by Finance Providers when considering lending or potential buyers if the business is put up for sale.

Common Balance Sheet Terms Defined

Assets

An asset is something tangible that your business owns. Assets such as brand or reputation would not be considered assets on a balance sheet as they do not have a tangible value.

Assets on a balance sheet are usually grouped into 2 categories – fixed assets and current assets.

Current Assets

These are assets that will generally last less than 12 months. Cash is considered a current asset as are things easily converted to cash such as stock or inventory.

Fixed Assets

These are assets that will remain with the business beyond 12 months. Fixed assets include items like equipment, buildings, machinery and vehicles.

Liabilities

A liability is an amount that you owe. Like assets these are generally grouped into two categories – current liabilities and long-term liabilities

Current Liabilities

This is an amount owed that needs to be paid off within the next 12 months. Taxes and accounts payable fall into this category.

Long term Liabilities

These are longer term loans and liabilities for example mortgages or lease payments for buildings or company vehicles.

Debt Ratio

This is the ratio of total debts compared to total assets. In some industries there is a maximum acceptable debt ratio, this will vary from industry to industry.

Owner’s Equity

The overall value of the business once the total liabilities have been subtracted from the total assets.

Technology and Balance Sheets

In days gone by a Balance Sheet was a document prepared by an accountant once a year. The invention of modern accounting software has made creating Balance Sheets far easier and enables businesses to create a Balance Sheet any time they choose. At Spectrum Accounting Xero is our preferred software for efficiency, accuracy and security of information.

Getting it Right

It is imperative that your Balance Sheet is an accurate reflection of your financial position. Leaving off just one asset or liability can throw out your results significantly. For expert, professional assistance with your Balance Sheet and other financial documentation, talk to the team at Spectrum Accounting.

Help! My books are in a mess!

Uh Oh, something’s gone wrong! Your books are in a mess, the IRD are breathing down your neck and you don’t know where to start.

This is a stressful situation to be in, needing to meet your compliance obligations but not really sure what has gone wrong, let alone how to fix it.

First off, relax, it’s going to be okay. You are not the first, and you certainly won’t be the last to find yourself in this position.

Ok, now you have some options.

1. DIY

You can absolutely have a crack at fixing things up yourself. Combing back through your books can allow you to identify where things went wrong and rectify them. If a clear fix isn’t evident, the IRD website is full of useful information and their staff are willing to provide advice over the phone or through MyIR. On the other hand … There’s option 2.

2. Get Professional Help

This is usually the most time-efficient option. A professional bookkeeper or accountant lives and breathes accounts and will usually be able to identify and fix issues quickly and efficiently and let you know what to do to satisfy the IRD. You may wish to take the relationship further and engage their services on an ongoing basis in order to prevent future issues with your books and tax obligations.

What to look for when choosing a professional bookkeeper or accountant?

• Expertise

Make sure you are talking to an expert who has proven success in this area and ideally one who has proven experience with a business similar to yours. Some will have specific services built around identifying and rectifying issues such as Spectrum Accounting’s Fix-Up service.

• Communication

Ideally you don’t want to find yourself in this position ever again so look for an accountancy service provider like Spectrum Accounting who will keep you across your financial position throughout the year with regular catch-ups and reports.

• Technology and Systems

The days of handwritten ledgers are well behind us. Good accounting software can make a huge difference in the time and effort it takes to keep your books in order. At Spectrum Accounting we prefer Xero for security, visibility, and efficiency. We offer training to our clients on how to maximise the Xero experience.

• Location and Availability

You need to be able to access help when you need it so consider where potential accountancy service providers are based and whether their availability fits with your business. A provider who is geographically close to you may be tempting but in this age of lockdowns and social distancing, a provider who can competently provide their services online may be a better option. Spectrum Accounting are located in Auckland but are entirely cloud-based so they can serve clients anywhere in New Zealand. They are also available 7 days a week.

If your books are keeping you up at night, Spectrum Accounting would love to talk to you. Give us a call today to see how we can help you.

Why is regular Bookkeeping important for businesses?

Every successful business is built with a solid foundation. A key component of that foundation is regular bookkeeping. Regular bookkeeping can not only keep you out of trouble with the Inland Revenue Department, but it can also help you grow your business through effective cash flow management and accounting policies.

What is Bookkeeping?

Bookkeeping is the process of maintaining financial records of a business. Every business has some type of bookkeeping that they will perform on a monthly or even daily basis. Tasks like payroll, bank reconciliations and invoicing are some of the most common bookkeeping tasks. These tasks need to be performed regularly in order to stay up to date with information. A lack of timely bookkeeping can lead to errors, lost items and even fraud. Monthly controls surrounding bookkeeping can help keep your business running smoothly.

Benefit #1: Saves You Time and Money

Regular bookkeeping has many benefits to you and your business. Staying on top of bookkeeping can save you time at the end of the year when it is time to file your business or personal return. You won’t have to spend countless hours searching for receipts and transactions, instead the year should be fairly complete. Moreover, regular bookkeeping can help you avoid late filing penalties which can range from $50 to $500. The Inland Revenue Department can be very strict on imposing late filing penalties, all of which can be avoided with the assistance of monthly bookkeeping.

Benefit #2: Accurate Financial Data

Just like regular bookkeeping can save you money, it can also help ensure that you have accurate financial data. Transactions are more likely to be entered correctly when they are done shortly after receiving the information. If you wait until the end of the year to reconcile your accounts and enter information, you heighten your risk of incorrect data. This can be detrimental to your business since taxes are calculated based upon the financial data from your accounting software. Duplicate entries can cost you more money in taxes, especially on the GST tax. Avoid future amendments and correspondence with the Inland Revenue Department by ensuring your data is accurate when you enter it.

Benefit #3: Promotes Business Growth

Accurate financial data leads to business growth. Regular bookkeeping helps you maintain accurate records which can be used for business planning and projections. Business planning is essential for steady growth. Planning future labor needs, supply orders and capital needed are all factors that come with business growth. Regular bookkeeping can help you reach these goals by giving you a clear picture of your business’s financial health. You don’t want to be scrambling for money or to find a labor force because your books weren’t reconciled. Effective cash flow management stems from transparency in the accounting records. Without regular bookkeeping, you won’t be able to fully understand where your business stands.

Benefit #4: Avoid Letters from the Inland Revenue Department

Another reason why your business needs regular bookkeeping is to effectively handle the Inland Revenue Department. As mentioned before, the Inland Revenue Department can be very strict when imposing penalties. Sometimes the Inland Revenue Department can be wrong about the fines and penalties they impose, making sound bookkeeping necessary to prove you don’t owe any penalties. Moreover, you can potentially request penalty abatement if you have sufficient evidence to support your viewpoint. The Inland Revenue Department often times gives you a short amount of time to respond to the letter and pay any fines or penalties. If you are behind on your bookkeeping, you may miss the deadline to respond for penalty abatement, highlighting the important of staying consistent with monthly bookkeeping tasks.

Benefit #5: You Learn the Whole Business Process

Learning how to bookkeep for your business can come with a learning curve. Accounting is hard, especially when you have New Zealand tax laws to follow. Learning the entire business process, from invoicing to providing the good or service, is critical for you to grow your business. How do you expect to pass the task off to someone else if you don’t understand how to complete it yourself? Take the time to learn the laws and regulations surrounding monthly bookkeeping. It will pay off in the long run.

Bookkeeping is a critical component of every business, from a one-man company to a company with a hundred employees. Don’t be stuck warding off the Inland Revenue Department because of racked up fines and penalties from late filing and inaccurate records. The few hours a week or month spent doing bookkeeping tasks will reap significant results in the end.

Interest deductions on residential property income & Bright-line test 2021: What the proposed changes mean to you

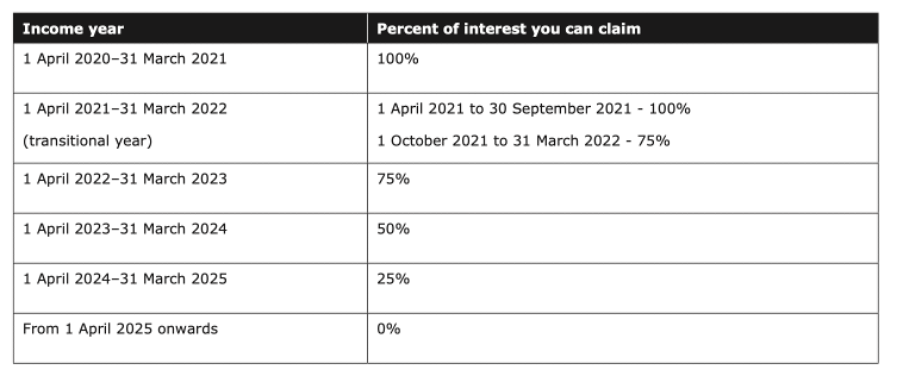

There have been proposed changes for residential properties acquired on or after 27 March. The current law states that residential property owners can deduct the interest on loans when calculating their taxable incomes and claim them as an expense. This reduces the tax amount they need to pay.

From 1 October 2021, there will be no interest deductions allowed on residential properties acquired on or after 27 March 2021. Interest on loans can still be claimed as an expense; however, the amount you can claim will be reduced over the next four years until it is completely eliminated. The table below shows that the interest amount claimed as an expense will be reduced by 25% each income year and eliminated by 2025-26 income year.

You can request further information or give us a call, and we will guide you through the latest changes and what they mean to you and your income tax.

What happens if you got a loan to improve or maintain your property on or after 27 March 2021? You will not be able to claim interest on this loan as an expense starting from 1 October 2021. This means that you will pay more tax on any property income you receive.

Say you made an offer before 27 March 2021 but acquired property on 27 March. Then your property will be treated as it was acquired before 27 March. This means that you will be able to claim interest as an expense based on the table provided above.

Obtaining any additional debt from drawing on the loan or taking a new loan related to the investment property on or after 27 March 20201 means interest on that portion of the loan will not be claimed as an expense after 1 October 2021.

When obtaining a loan for business use but secured against residential property, no changes are applied. Builders and property developers will be able to claim interest on a loan as an expense.

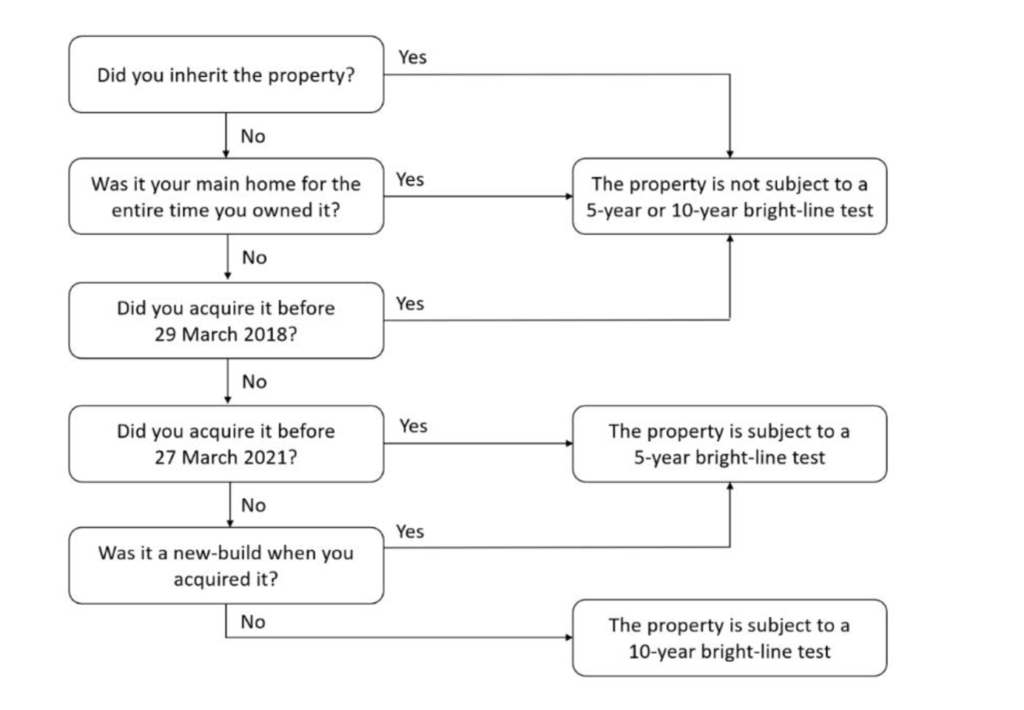

Bright-line test proposed changes

The government proposed the bright-line test to be extended from 5 to 10 years, which means that you will have to pay tax on any profit made through property increasing value over time for a set period after acquiring a residential property. Newly built houses are an exception and inherited properties and those considered as owner’s primary home for the entire time they owned it.

The chart below provided by IRD explain the proposed changes to the bright-line test.

The date you acquired a property determines whether the bright-line is 5 or 10 years. This will also determine which set of rules relating to the main home exclusion and change of use will apply to your property.

There is no clear definition of a new build as yet, and it will be defined and clarified in consultation with the tax and property communities. The intention is to define a new build as property acquired within a year of receiving a code of compliance certificate under Building Act 2004.

If a residential property, including new builds, is acquired on or after 27 March 2021, there may be a “change-of-use” rule applied by the government. This basically means that tax will be calculated differently if the property was not used as the owner’s main home for over 12 months at a time during the applicable bright-line period.

If the owner does not use the property as the main home for 12 months or less there is no change of use (for example) if the owner takes a few months to move into our out of a property this till means that the days are counted as main home use and the bright-line test is not applied.

The owner of a property subject to the change-of-use rule will be required to pay income tax on a proportion of the profit made through the property increasing in value, calculated as follows:

• subtract the purchase price from the sale price

• subtract the cost of capital improvements the owner has made

• subtract the costs to buy and sell the property, and

• multiply the result by the proportion of time the property was not being used as the owner’s main home.

What the proposed changes mean for you

If you own property for more than ten years (or over five years for new builds), you won’t have to pay tax under the bright-line test.

If a property is sold within ten years of acquiring it (or five years for a new build) and it was the owner’s main home for the entire time, there is no obligation to pay tax under the bright-line test on any value gain of the whole period. In case of the property being used for other purposes for over 12 months during the time owned, there is an obligation to pay income tax on the value gained over time, and it is considered as profit.

If the owner decided to sell the property within ten years of acquiring it (or five years for a new build) and it was never owner’s main home for the entire time of ownership, there will be income tax to pay on any value gained under the bright-line test.

Contact Spectrum Accounting for an initial consultation, and as tax consultants, we will help you have all your taxes under control.

IR and ACC: No cheques from 1 March

Inland Revenue and ACC will no longer accept payments by cheque. Here’s what you need to know.